Future energy – geothermal power

Always on, flexible power that could become central to net zero ambitions. Could geothermal power be a surprise package among the plethora of low-carbon technologies?

Could geothermal power be a surprise package among the plethora of low-carbon technologies? Wind and solar are cost competitive and already in pole position to capture much of the exponential growth in power supply as the world electrifies over the next three decades. But geothermal is another proven technology that is arguably less risky than other wannabe technologies like hydrogen and CCS, which are similarly costly but technically still have much to prove.

As a very local energy resource, geothermal would bolster security of supply. Prakash Sharma, Director Energy Transition Service, and Dr Andrew Latham, Vice President Energy Research, have scoped out how new, sophisticated systems might lift geothermal from the periphery to become central in the global drive to net zero.

First, solar and wind can’t do it all on their own. Intermittency, or more precisely variability, is a problem. In the power system of the future, wind and solar will need to be complemented by batteries to meet peak demand – and by clean, dependable baseload. That’s where geothermal comes in. It’s an ‘always on’ power source that can also be flexible.

Second, the resource is well understood, and the conventional technology proven. Geothermal uses the earth’s natural heat emanating from the core where the temperature is 5,500 °C, almost as hot as the sun. From the ground downwards, temperature rises by about 30 °C each kilometre of depth on average, based on Wood Mackenzie’s Lens database of 38,000 oil and gas reservoirs. Around 8% of those reservoirs have a gradient above 40 °C per kilometre. Temperature gradients only deviate from these typical ranges in unusual geological settings, such as near hot volcanic rocks.

Surface or near-surface geothermal has been used in heat and power for decades. Ground source heat pumps are already widely in use and set for the mass market. These heat exchangers exploit temperature difference caused by the sun just below ground level. Heat pumps are central to the EU’s ‘Fit for 55’, which aims to displace gas and oil in residential and commercial space heating.

Conventional geothermal energy systems tap into shallow hydrothermal resources at depths of up to 200 metres. The energy is hot water and steam, used to drive a turbine. These conventional projects work in locations with exceptional temperature gradients, such as Iceland or the Pacific ‘Ring of Fire’.

The big opportunity is to scale up, go deeper and, most importantly, go global. Enhanced and advanced geothermal systems (EGS/AGS) will exploit rocks at up to 3-km depth and more. In the most sophisticated systems, a horizontal well through the ‘hot’ rock formation will be linked to the surface by two vertical wells creating a closed loop.

Water from a source on the ground will be injected, cycled through the formation and back up to the turbine at the surface – repeated in perpetuity. These complex systems depend on advanced drilling and well completion techniques that are in common use in the oil and gas industry.

Predictable temperature gradients mean that EGS/AGS projects can be location-agnostic, bringing large-scale geothermal near to many big demand centres.

Third, costs have to come down. The resource itself is free, so variable costs are negligible. It’s all about upfront capital spend – drilling and completing wells are correlated with depth.

Drilling the complicated bore systems is an expensive business, as the oil industry will attest. The bonus is that, once drilled, a geothermal well should deliver consistent low-carbon heat for decades.

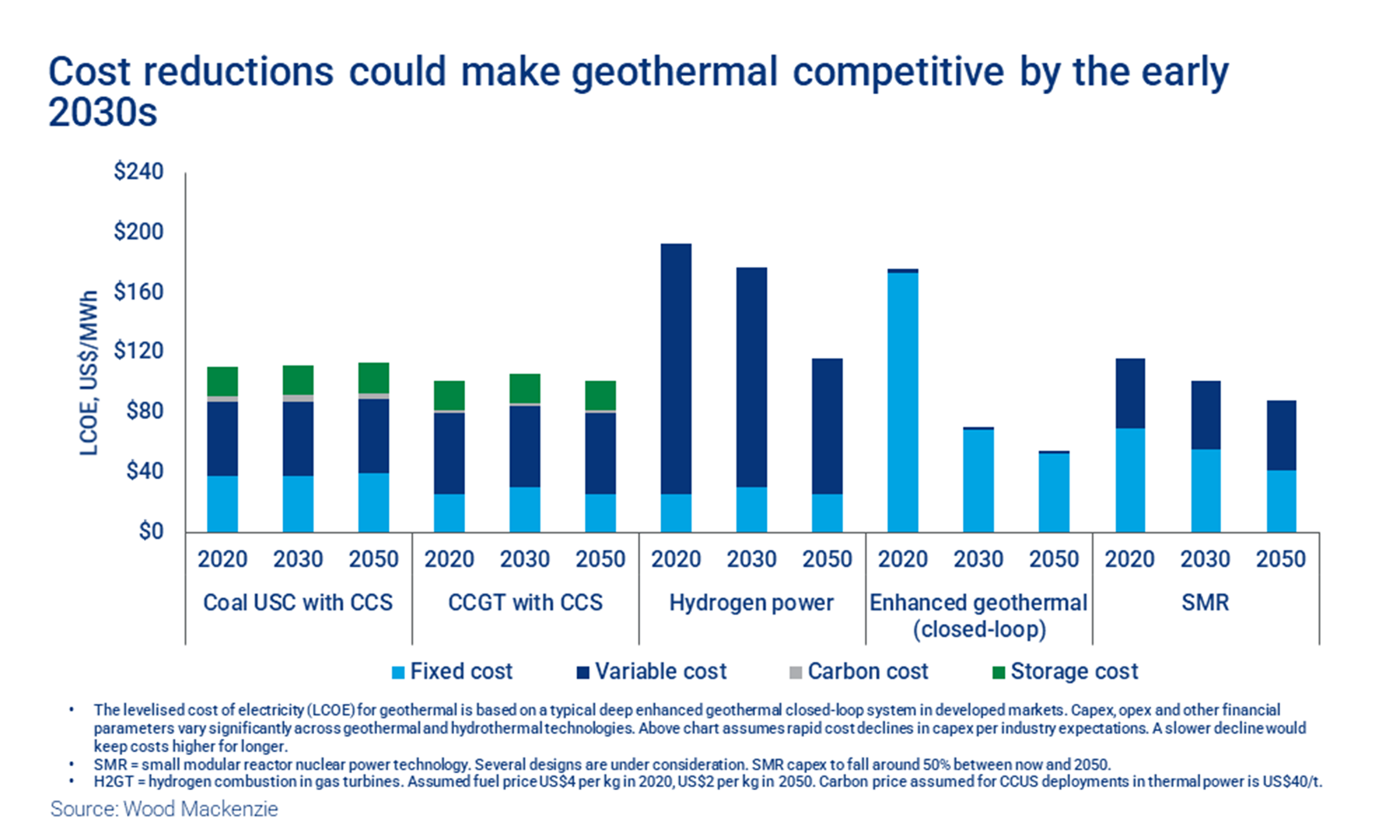

The levelised cost of electricity (LCOE) of AGS/EGS projects today is around US$180/MWh, based on a handful of experimental projects. We expect a ramp-up of government support, technology innovation in high-temperature drilling tools and an influx of investment will drive costs down dramatically, as we’ve seen with wind and solar over the past decade.

In our view, costs of US$75/MWh by 2030 and US$55/MWh by 2050 are achievable, cheaper than coal or gas fitted with CCS or small modular nuclear reactors. Co-production, including the extraction from groundwater of high-value lithium for batteries or green hydrogen, may improve the economics further.

The project pipeline is gathering steam. Chevron, BP, EnBW and Mitsui (Moeco) are among the major energy companies investing with geothermal specialists such as EavorLoop, Greenfire and Causeway GT in active projects in New Zealand, Canada (Alberta), the US (California, Utah, Nevada), Germany, Iceland, Japan and the UK.

Fourth, there’s the size of the prize. Electricity demand more than doubles by 2050 in our 1.5 °C and 2.0 °C scenarios (AET-1.5 and AET-2). New solar and wind capacity captures most of the 10,000 GW growth in generating capacity, whereas geothermal reaches a mere 100 GW, less than 1%. The US Department of Energy’s ‘Geovision’ from May 2019 is much more bullish, reckoning the US alone could have 60 GW of geothermal capacity by 2050, meeting 8.5% of US power demand.

A competitive LCOE would be game-changing. We think global geothermal capacity has the potential to exceed 1,000 GW by 2050, bigger than either global nuclear or hydro capacity today.